Government Announces Major Tax Cuts in 2025 Budget

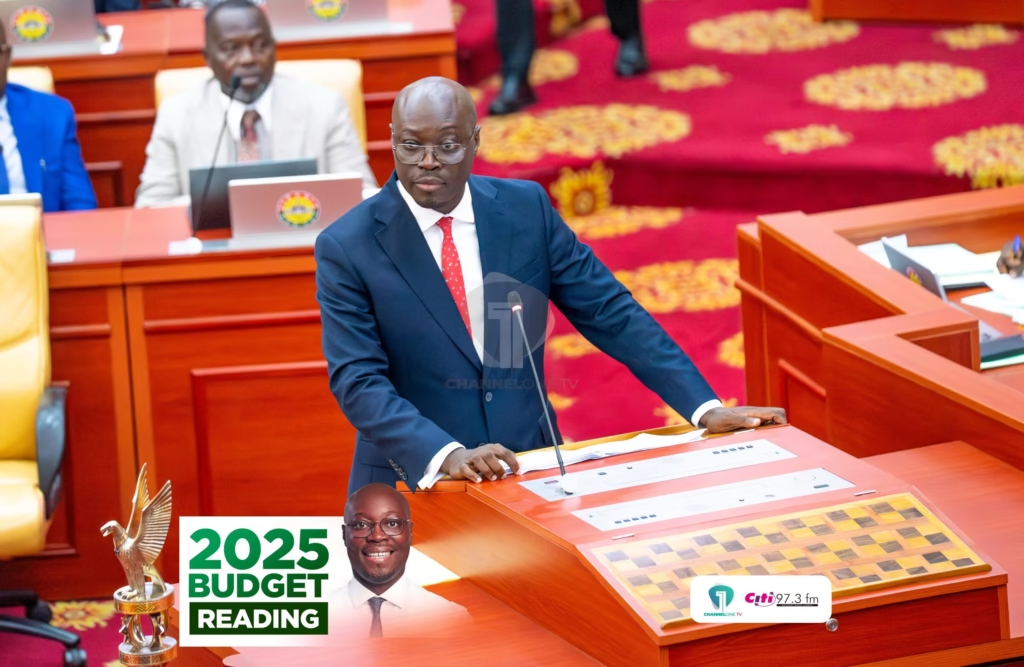

The government has unveiled plans to abolish several key taxes in the 2025 budget, a move aimed at boosting disposable incomes and supporting business expansion. Finance Minister Dr. Cassiel Ato Forson detailed the tax cuts during his budget presentation in Parliament, emphasizing their positive economic impact.

For official details, visit the Ministry of Finance.

Key Tax Abolitions in 2025 Budget

During the budget presentation, Dr. Forson announced the removal of multiple taxes that have been considered burdensome by businesses and individuals:

- 10% Withholding Tax on Lottery Winnings (Betting Tax)

- 1% Electronic Transfer Levy (E-Levy)

- Emission Levy on industries and vehicles

- VAT on motor vehicle insurance policies

- 1.5% Withholding Tax on unprocessed gold for small-scale miners

“Mr. Speaker, we will abolish these taxes to relieve financial pressure on households, enhance disposable incomes, and create a more favorable environment for businesses to thrive,” Dr. Forson stated.

How These Tax Cuts Benefit Ghanaians

The removal of these levies is designed to stimulate economic activity, particularly for small businesses and lower-income households.

“The removal of these taxes will ease the burden on households and improve their disposable incomes. In addition, it will support business growth and improve tax compliance,” Dr. Forson explained.

For more insights into tax policies, visit the Ghana Revenue Authority.

Economic Implications and Future Outlook

The abolition of these taxes is expected to:

- Encourage investment and job creation.

- Improve cash flow for businesses and individuals.

- Enhance tax compliance and broaden the tax base.

Stay updated on Ghana’s 2025 budget policies and how they impact businesses and individuals nationwide.